Locating the most ideal Auto Insurance Policy in Las Vegas NV

Greatest Auto Insurance Coverage Carriers in Las Vegas

When it concerns finding the best auto insurance policy in Las Vegas, it is actually vital to take into consideration the coverage options each company provides. A professional insurance coverage company need to give detailed and also collision coverage to shield both the driver as well as their vehicles in the event that of mishaps or even harm. Furthermore, it is crucial to search for a company that offers discounts to help lower the total costs of the insurance policy. By matching up quotes coming from different providers in Las Vegas using your zip code, you can easily discover the most effective costs that suit your finances as well as coverage demands.

Opting for the absolute best car insurance policy service provider in Las Vegas also involves evaluating the company's customer support and exactly how they deal with claims. A trusted insurance provider should have an uncomplicated cases method and be actually receptive to any type of concerns or issues that the insurance policy holder may possess. It is actually additionally necessary to think about the driving history of the covered by insurance individual, as this can impact the costs of the insurance policy. Through putting in the time to investigation and also compare various insurance coverage carriers in Las Vegas, you may locate a company that provides the correct coverage, discounts, and customer support for your specific demands.

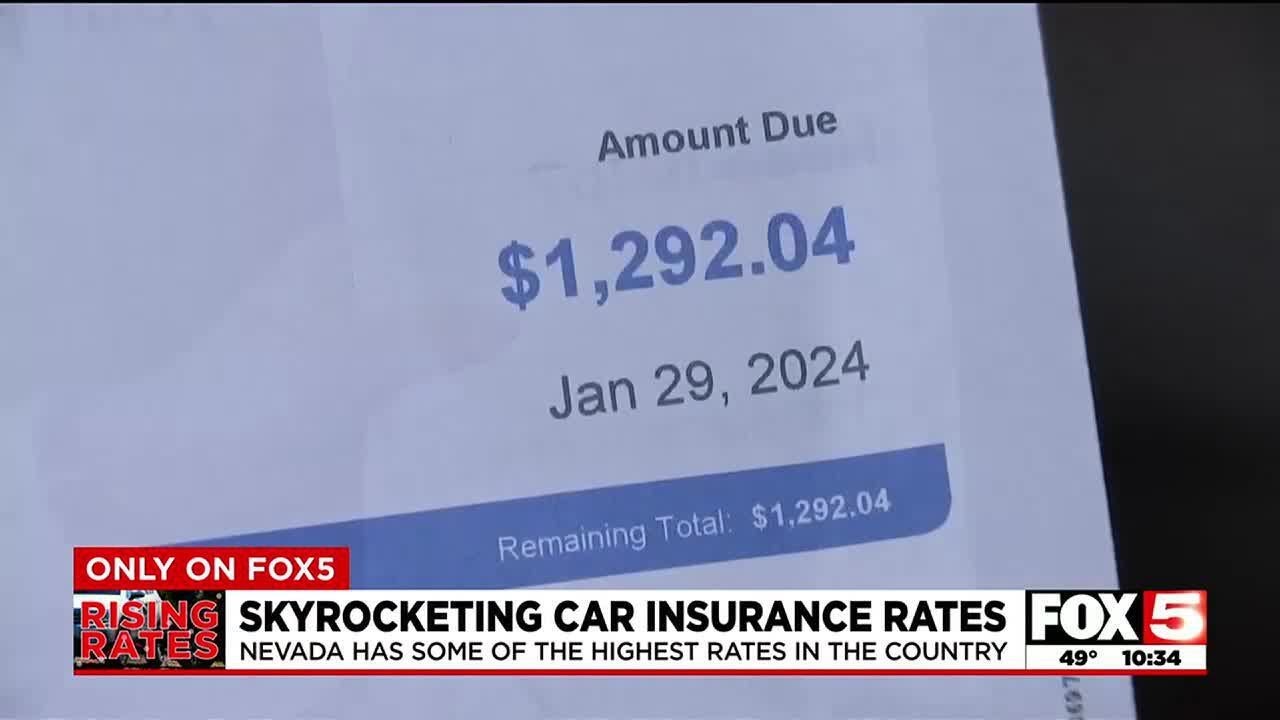

Typical Auto Insurance Policy Costs in Las Vegas

When examining the common car insurance coverage costs in Las Vegas, it is crucial to think about various aspects that can determine the prices given through insurance companies. The sort of coverage chosen, like bodily injury liability coverage as well as property damage liability coverage, participates in a considerable part in identifying the total expense of insurance policy. Individuals along with a clean driving record might take advantage of lower fees as insurance companies watch all of them as lower threat. However, those along with a history of at-fault accidents might see higher ordinary costs as a result of the improved threat they pose to insurance providers.

In Las Vegas, the average cost of auto insurance coverage may vary relying on details demographics and also individual driving past histories. While it's vital to locate a harmony between cost and coverage, it's additionally necessary to prioritize protection over savings. Buying extensive insurance coverage may deliver increased satisfaction in the unlikely event of an unforeseen accident or even damages. Through knowing exactly how one is actually driving record impacts insurance rates and also reviewing quotes from several suppliers, individuals may produce well informed choices to safeguard appropriate insurance at a reasonable rate.

Aspects Affecting Insurance Rates in Las Vegas

Aspects having an effect on insurance rates in Las Vegas vary based upon different criteria. Insurers think about elements like the city where the automobile is mostly stationed, making use of mobile phone tools while driving, and any type of prior web traffic violations, such as tickets. Insurance policy quotes can additionally be actually affected by the kind of coverage picked, varying coming from minimum coverage to complete options that supply greater coverage each just in case of an incident. Teen drivers can substantially affect insurance coverage costs, as they are considered much higher threat chauffeurs and may trigger improved costs when incorporated to an auto policy.

In Las Vegas, the incidence of distracted driving because of mobile device consumption can easily raise insurance rates as it increases the probability of mishaps. Besides this, the city's traffic jam as well as the frequency of tickets issued can likewise contribute to much higher insurance policy costs. When finding insurance policy quotes, it is vital to take into consideration all these aspects to locate the best suitable coverage at reasonable costs.

Cost Variety for Different Demographics in Las Vegas

When it happens to auto insurance rates in Las Vegas, the cost selection for different demographics can easily differ significantly. Variables including grow older, sex, driving history, and credit report can all contribute in establishing how much you'll pay off for coverage. Female drivers, as an example, might delight in lesser prices than male chauffeurs because of statistically being actually included in less incidents. Responsible drivers along with a clean driving record and no previous insurance coverage cases might additionally gain from lesser premiums compared to those along with a past history of crashes or even traffic infractions.

Insurance companies in Las Vegas deal auto insurance rates several coverage limits and additional coverage options that can easily influence the monthly premium you pay out. As an example, including comprehensive coverage or anti-theft tools to your policy might improve your protection but additionally increase your costs. It's vital to review your insurance policy needs to have properly as well as check out any kind of on call insurance discounts that might assist reduce your superiors. Whether you are actually a brand-new driver getting your license or a professional driver aiming to shift service providers, reviewing quotes from a number of business is actually essential to discovering the greatest auto insurance coverage that matches your finances and also necessities.

Impact of Driving Records on Insurance Rates in Las Vegas

Having a clean driving record in Las Vegas can considerably influence your car insurance rates. Chauffeurs along with a pristine past history are actually a lot more likely to get approved for affordable rates compared to those along with a record of mishaps or website traffic infractions. Insurance coverage companies in Las Vegas commonly consider elements including traffic tickets, incidents, as well as DUI sentences when determining the price of coverage. Through keeping a clean record, chauffeurs can assume to get reduced fees and also potentially get approved for extra discounts used through insurance companies.

When trying to find affordable car insurance in Las Vegas, it's vital to become knowledgeable about the minimum requirements established due to the state. Nevada mandates chauffeurs to carry liability insurance that features bodily injury coverage and also property damage liability. Additionally, uninsured motorist bodily injury coverage and medical payments coverage are actually also component of the mandatory demands in Nevada. Through informing yourself with these minimum requirements, you can ensure you are fulfilling legal requirements while likewise exploring choices to safeguard the greatest prices possible coming from insurance coverage providers.

Optional Protections in Las Vegas

When it involves optionally available protections in Las Vegas, vehicle drivers possess a wide array of choices to consider. Insurance policy carriers in the location frequently offer additional coverage options beyond the minimum demanded liability coverage limits set through Nevada's insurance policy requirements. These extra coverages can easily feature enhanced liability coverage limits, coverage for vehicle drivers with a lapse in coverage, and coverage per accident beyond the essential minimum coverage requirements.

For instance, 20-year-old drivers or even single drivers might discover it advantageous to check out optionally available coverage selections to ensure they have sufficient protection in the event of a collision. These drivers might yearn for to take into consideration adding detailed and also collision coverage to their policies, which can easily help cover the price of damages to their very own car aside from liability coverage for damages to various other vehicles. Through checking out the coverage availability and rates for drivers in Las Vegas, people can tailor their insurance to greatest suit their necessities as well as budget.

Nevada's Insurance policy Requirements

When it involves auto insurance in Nevada, it is vital to comprehend the state's insurance policy needs. Nevada rule mandates that all drivers bring a minimum-coverage policy that consists of liability coverage. This kind of auto insurance policy assists cover costs connected to traumas or building damages if you are actually at fault in a crash. Individuals along with a well-maintained driving history and safe driving habits may also apply for reduced insurance rates. In addition, knowing teen driving laws in Nevada may assist parents navigate insurance coverage costs when adding younger chauffeurs to their policy.

In Nevada, the cost of auto insurance may differ relying on a number of elements. It's important to look at not just the annual cost of superiors but additionally possible repair costs and deductibles. Motorists in Las Vegas need to look into multi-policy discounts that may be actually given through insurance policy providers. In enhancement, variables like credit scores and also client satisfaction scores may participate in a duty in establishing personalized quotes. Students may additionally be actually qualified for a student discount, which may help in reducing the general cost of auto insurance.

Auto Insurance Discounts to Consider in Las Vegas

Auto insurance discounts can easily aid chauffeurs in Las Vegas spare funds on their premiums. Some insurance firms provide discounts based upon a driver's really good driving record, such as possessing no accidents or even speeding tickets. Maintaining a clean driving record may considerably influence the cost of insurance. In Las Vegas, where the average car insurance rates can be actually much higher because of variables like website traffic congestion as well as the higher demography of Nevada's largest city, making use of discounts may create a distinction.

Different auto insurers in Las Vegas might provide various types of discounts, so it's important to contrast quotes as well as discover possibilities. Discounts might additionally be on call for particular kinds of vehicles, such as those along with innovative safety and security features or vehicles that possess a solid safety ranking coming from companies like J.D. Power. Additionally, some insurers might give discounts for finishing protective driving training courses or for bundling multiple plans, such as automotive and home insurance policy, with all of them. Investigating the accessible discounts as well as finding the ones that use to your certain condition may aid decrease the overall price of insurance policy in Las Vegas

Tips for Strategic Looking for Auto insurance in Las Vegas

When buying Auto Insurance in Las Vegas, it is very important to know the rating factors that insurance policy carriers think about when determining your premium. Variables such as your driving record, age, and the sort of auto you steer can easily all influence the expense of your insurance policy. By being informed of these elements, you can make well informed decisions to help lower your fees.

One recommendation to consider is to choose electronic format when acquiring your insurance documentations. A lot of insurance companies, like Mercury Insurance, provide discounts if you select to receive your policy information digitally. In addition, sustaining continuous insurance coverage and preventing declaring insurance claims for minor occurrences like a fender bender can assist you safeguard the cheapest car insurance rates. Comparing sample rates coming from various carriers for coverage options like liability insurance, damage per accident, and injury per accident can likewise help you locate the cheapest rates for your details requirements. Look at working out with your company for a reduced annual rate based upon their sample rates and your driving history.

Comparing Quotes coming from Various Providers in Las Vegas

When comparing quotes coming from a number of carriers in Las Vegas, it is essential to think about several factors that can impact the price of your auto insurance policy fees. One key part to take a look at is actually the rates of accidents in the location, as insurance companies often readjust their prices based upon the amount of threat linked with a particular location. Also, recognizing the liability limits delivered through each company is vital to guarantee you have enough coverage in the event of a crash. It is vital to pay out focus to the injury per person limitation, as this may significantly have an effect on the quantity of remuneration readily available to cover medical expenses.

Moreover, when securing quotes from different service providers in Las Vegas, it is necessary to match up the rates versus the citywide average to obtain a much better sense of what comprises a reasonable price. Also, recognizing the minimum level of coverage called for in Nevada, featuring uninsured motorist protection, can aid you create an updated decision when opting for an insurance carrier. By properly evaluating these factors as well as obtaining multiple quotes, you can discover the best car insurance coverage that suits your requirements as well as finances in Las Vegas.